6 Big Things Your Homeowners Insurance Doesn’t Cover

[vc_row][vc_column][vc_custom_heading text=”6 Big Things Your Homeowners Insurance Doesn’t Cover”][vc_single_image image=”534″ img_size=”full”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Do you know exactly what your homeowners insurance covers? If not, take a close look at your policy. Your insurance company will recoup costs for most accidents and disasters, but some things just aren’t covered.

Understanding what your homeowners insurance doesn’t cover and why can help you plan ahead. Knowing where you’re vulnerable also enables you to make smart choices that could prevent or minimize your financial liability in the case of an accident or disaster.

Trampolines are actually more dangerous than they might look. According to the U.S. Consumer Product Safety Commission (CPSC), in 2012, an estimated 94,900 people were treated in emergency rooms for trampoline sustained injuries. From 2000 to 2009, 22 deaths resulting from trampoline accidents were reported to the commission. Injuries include colliding with another person, landing improperly and breaking or injuring limbs, getting hurt falling or jumping off and receiving injuries from hitting the trampoline’s springs or frame.

Trampolines are actually more dangerous than they might look. According to the U.S. Consumer Product Safety Commission (CPSC), in 2012, an estimated 94,900 people were treated in emergency rooms for trampoline sustained injuries. From 2000 to 2009, 22 deaths resulting from trampoline accidents were reported to the commission. Injuries include colliding with another person, landing improperly and breaking or injuring limbs, getting hurt falling or jumping off and receiving injuries from hitting the trampoline’s springs or frame.

Given the fact that dog bites cost insurance companies an estimated $250 million a year, it’s not surprising that certain breeds with aggressive tendencies are considered off limits when it comes to homeowners insurance. Even if you have a sweet, happy pouch, you’re unlikely to find insurance for any bites or attacks caused by certain breeds, including German shepherds, pit bulls, Dobermans, Rottweilers and even Labrador Retrievers. Some insurance companies will also refuse to insure against dog bites if your best friend has a history of aggression.

Given the fact that dog bites cost insurance companies an estimated $250 million a year, it’s not surprising that certain breeds with aggressive tendencies are considered off limits when it comes to homeowners insurance. Even if you have a sweet, happy pouch, you’re unlikely to find insurance for any bites or attacks caused by certain breeds, including German shepherds, pit bulls, Dobermans, Rottweilers and even Labrador Retrievers. Some insurance companies will also refuse to insure against dog bites if your best friend has a history of aggression.

If you want flood insurance, you must buy a separate flood insurance policy. This has been the case since 1968 when the government founded the National Flood Insurance Program, which is part of FEMA (Federal Emergency Management Agency.) Premiums for separate flood insurance vary according to your geographic area’s flood risk. There is usually a 30-day waiting period on new flood insurance.

Also be aware that sewage backups, even though they may be related to a flooding situation, are not covered within a flood insurance policy. In order to cover your home in case of the sewer backing up into your house or the sump pump overflowing, you must purchase a sewage backup rider for your main insurance.

If you want flood insurance, you must buy a separate flood insurance policy. This has been the case since 1968 when the government founded the National Flood Insurance Program, which is part of FEMA (Federal Emergency Management Agency.) Premiums for separate flood insurance vary according to your geographic area’s flood risk. There is usually a 30-day waiting period on new flood insurance.

Also be aware that sewage backups, even though they may be related to a flooding situation, are not covered within a flood insurance policy. In order to cover your home in case of the sewer backing up into your house or the sump pump overflowing, you must purchase a sewage backup rider for your main insurance.

Earthquake is another natural disaster not covered in your standard homeowners insurance. To get coverage for the extensive damage quakes can cause, including home replacement, you must get an additional earthquake policy. Most major insurers offer earthquake insurance, or you can purchase a policy from the California Earthquake Authority (CEA), which was created in the wake of the devastating 1994 Northridge, Calif. earthquake that resulted in $10 billion in losses.

It’s strongly suggested that homeowners in the high risk “Pacific earthquake belt” get quake insurance, as approximately 81 percent of the world’s largest earthquakes occur in this region, which runs from Southern California up the west coast to Alaska.

Earthquake is another natural disaster not covered in your standard homeowners insurance. To get coverage for the extensive damage quakes can cause, including home replacement, you must get an additional earthquake policy. Most major insurers offer earthquake insurance, or you can purchase a policy from the California Earthquake Authority (CEA), which was created in the wake of the devastating 1994 Northridge, Calif. earthquake that resulted in $10 billion in losses.

It’s strongly suggested that homeowners in the high risk “Pacific earthquake belt” get quake insurance, as approximately 81 percent of the world’s largest earthquakes occur in this region, which runs from Southern California up the west coast to Alaska.

If we have any type of war—including nuclear, conventional or civil, your home won’t be covered. The good news is, though, that unless your policy says otherwise, you should be covered in the case of a terrorist attack.

If we have any type of war—including nuclear, conventional or civil, your home won’t be covered. The good news is, though, that unless your policy says otherwise, you should be covered in the case of a terrorist attack.

A spate of costly mold claims in the early 2000s caused insurance companies to adjust policies to either deny mold coverage outright or add limits. Some companies exclude all coverage for mold related issues, except for mold resulting from fire or lightening, while others offer a limited amount of coverage—such as a cap of $5,000. Some coverage is situational. For instance, you might be able to obtain coverage if the mold was caused by a sudden occurrence like a burst pipe, but you would not be covered if the condition was caused by leaking pipes that you failed to maintain. Additional mold coverage can also sometimes be added as a rider.

Find out exactly what is and isn’t covered by your homeowners insurance, and avoid being blindsided if an accident or disaster strikes.

Julie Bawden-Davis is a staff writer for SuperMoney. Her mission is to help fight your evil debt blob and get your personal finances in tip top shape. Photos: Flickr[/vc_column_text][/vc_column][/vc_row]

A spate of costly mold claims in the early 2000s caused insurance companies to adjust policies to either deny mold coverage outright or add limits. Some companies exclude all coverage for mold related issues, except for mold resulting from fire or lightening, while others offer a limited amount of coverage—such as a cap of $5,000. Some coverage is situational. For instance, you might be able to obtain coverage if the mold was caused by a sudden occurrence like a burst pipe, but you would not be covered if the condition was caused by leaking pipes that you failed to maintain. Additional mold coverage can also sometimes be added as a rider.

Find out exactly what is and isn’t covered by your homeowners insurance, and avoid being blindsided if an accident or disaster strikes.

Julie Bawden-Davis is a staff writer for SuperMoney. Her mission is to help fight your evil debt blob and get your personal finances in tip top shape. Photos: Flickr[/vc_column_text][/vc_column][/vc_row]

1. Injuries sustained by trampolines

Yes, you read that right. If your kids and their friends (or you and your friends) are flying high on a trampoline located on your property and someone breaks a limb or two people knock heads, you are responsible. Some insurance companies won’t even insure residences that have a trampoline. Trampolines are actually more dangerous than they might look. According to the U.S. Consumer Product Safety Commission (CPSC), in 2012, an estimated 94,900 people were treated in emergency rooms for trampoline sustained injuries. From 2000 to 2009, 22 deaths resulting from trampoline accidents were reported to the commission. Injuries include colliding with another person, landing improperly and breaking or injuring limbs, getting hurt falling or jumping off and receiving injuries from hitting the trampoline’s springs or frame.

Trampolines are actually more dangerous than they might look. According to the U.S. Consumer Product Safety Commission (CPSC), in 2012, an estimated 94,900 people were treated in emergency rooms for trampoline sustained injuries. From 2000 to 2009, 22 deaths resulting from trampoline accidents were reported to the commission. Injuries include colliding with another person, landing improperly and breaking or injuring limbs, getting hurt falling or jumping off and receiving injuries from hitting the trampoline’s springs or frame.

2. Aggressive dog breed attacks

Given the fact that dog bites cost insurance companies an estimated $250 million a year, it’s not surprising that certain breeds with aggressive tendencies are considered off limits when it comes to homeowners insurance. Even if you have a sweet, happy pouch, you’re unlikely to find insurance for any bites or attacks caused by certain breeds, including German shepherds, pit bulls, Dobermans, Rottweilers and even Labrador Retrievers. Some insurance companies will also refuse to insure against dog bites if your best friend has a history of aggression.

Given the fact that dog bites cost insurance companies an estimated $250 million a year, it’s not surprising that certain breeds with aggressive tendencies are considered off limits when it comes to homeowners insurance. Even if you have a sweet, happy pouch, you’re unlikely to find insurance for any bites or attacks caused by certain breeds, including German shepherds, pit bulls, Dobermans, Rottweilers and even Labrador Retrievers. Some insurance companies will also refuse to insure against dog bites if your best friend has a history of aggression.

3. Floods, and sewage backup

If you want flood insurance, you must buy a separate flood insurance policy. This has been the case since 1968 when the government founded the National Flood Insurance Program, which is part of FEMA (Federal Emergency Management Agency.) Premiums for separate flood insurance vary according to your geographic area’s flood risk. There is usually a 30-day waiting period on new flood insurance.

If you want flood insurance, you must buy a separate flood insurance policy. This has been the case since 1968 when the government founded the National Flood Insurance Program, which is part of FEMA (Federal Emergency Management Agency.) Premiums for separate flood insurance vary according to your geographic area’s flood risk. There is usually a 30-day waiting period on new flood insurance.

Also, read > 3 Health Care Reforms to Look Out for This Year

4. Earthquakes

Earthquake is another natural disaster not covered in your standard homeowners insurance. To get coverage for the extensive damage quakes can cause, including home replacement, you must get an additional earthquake policy. Most major insurers offer earthquake insurance, or you can purchase a policy from the California Earthquake Authority (CEA), which was created in the wake of the devastating 1994 Northridge, Calif. earthquake that resulted in $10 billion in losses.

It’s strongly suggested that homeowners in the high risk “Pacific earthquake belt” get quake insurance, as approximately 81 percent of the world’s largest earthquakes occur in this region, which runs from Southern California up the west coast to Alaska.

Earthquake is another natural disaster not covered in your standard homeowners insurance. To get coverage for the extensive damage quakes can cause, including home replacement, you must get an additional earthquake policy. Most major insurers offer earthquake insurance, or you can purchase a policy from the California Earthquake Authority (CEA), which was created in the wake of the devastating 1994 Northridge, Calif. earthquake that resulted in $10 billion in losses.

It’s strongly suggested that homeowners in the high risk “Pacific earthquake belt” get quake insurance, as approximately 81 percent of the world’s largest earthquakes occur in this region, which runs from Southern California up the west coast to Alaska.

5. Nuclear, conventional, or civil war

If we have any type of war—including nuclear, conventional or civil, your home won’t be covered. The good news is, though, that unless your policy says otherwise, you should be covered in the case of a terrorist attack.

If we have any type of war—including nuclear, conventional or civil, your home won’t be covered. The good news is, though, that unless your policy says otherwise, you should be covered in the case of a terrorist attack.

6. Mold and water damage

A spate of costly mold claims in the early 2000s caused insurance companies to adjust policies to either deny mold coverage outright or add limits. Some companies exclude all coverage for mold related issues, except for mold resulting from fire or lightening, while others offer a limited amount of coverage—such as a cap of $5,000. Some coverage is situational. For instance, you might be able to obtain coverage if the mold was caused by a sudden occurrence like a burst pipe, but you would not be covered if the condition was caused by leaking pipes that you failed to maintain. Additional mold coverage can also sometimes be added as a rider.

A spate of costly mold claims in the early 2000s caused insurance companies to adjust policies to either deny mold coverage outright or add limits. Some companies exclude all coverage for mold related issues, except for mold resulting from fire or lightening, while others offer a limited amount of coverage—such as a cap of $5,000. Some coverage is situational. For instance, you might be able to obtain coverage if the mold was caused by a sudden occurrence like a burst pipe, but you would not be covered if the condition was caused by leaking pipes that you failed to maintain. Additional mold coverage can also sometimes be added as a rider.

Also, read > Nearly One-Third of Americans Can’t Afford Health Care

Project Link

Date:

© Julie Bawden-Davis

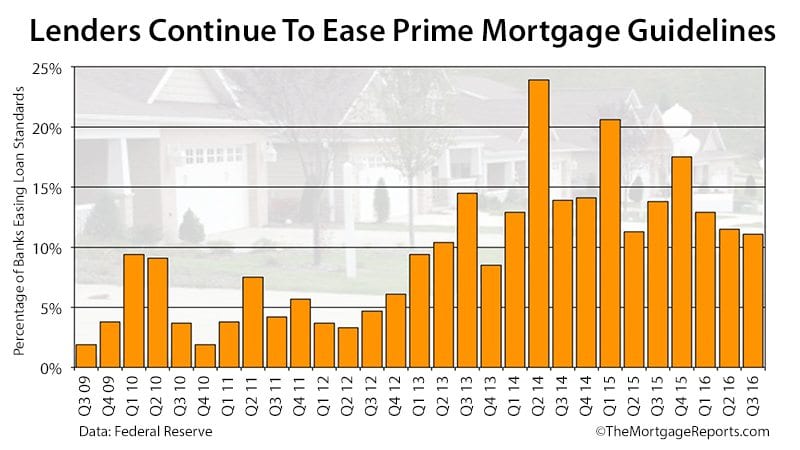

Facing reality is your first step in preparing your credit for buying a house. To get your credit score for free, try

Facing reality is your first step in preparing your credit for buying a house. To get your credit score for free, try  While your score gives you the specifics, your credit report offers the big picture. The information reflected on your credit report directly affects your score. For instance, it will show if you have any late payments on record and how much of your credit is currently in use.

Get a free credit report for all three major credit bureaus (TransUnion, Equifax and Experian) by visiting

While your score gives you the specifics, your credit report offers the big picture. The information reflected on your credit report directly affects your score. For instance, it will show if you have any late payments on record and how much of your credit is currently in use.

Get a free credit report for all three major credit bureaus (TransUnion, Equifax and Experian) by visiting  Understanding the ideal credit score range for buying a home helps you know what to aim for regarding your credit. Credit scores range from 300 (very poor) to 850 (excellent).

Understanding the ideal credit score range for buying a home helps you know what to aim for regarding your credit. Credit scores range from 300 (very poor) to 850 (excellent).

Considering that your score is directly affected by what is on your credit report, it’s important to verify that all of the information on your credit report is accurate. The

Considering that your score is directly affected by what is on your credit report, it’s important to verify that all of the information on your credit report is accurate. The  The lower the percentage of your credit you have in use, the higher your credit score will be. Prepare your credit for buying a new home by paying down your credit card debt as much as possible. Start with the largest balances, concentrating first on those cards that are maxed out or nearly maxed out.

We’ve got some great tips on paying down your credit card debts with

The lower the percentage of your credit you have in use, the higher your credit score will be. Prepare your credit for buying a new home by paying down your credit card debt as much as possible. Start with the largest balances, concentrating first on those cards that are maxed out or nearly maxed out.

We’ve got some great tips on paying down your credit card debts with  Once you’ve paid down credit card balances, wait 45 days for the changes to be reflected on your credit report. Also avoid using your credit cards while applying for a mortgage and while your home is in escrow. You want the balances to stay as low as possible during this time.

Once you’ve paid down credit card balances, wait 45 days for the changes to be reflected on your credit report. Also avoid using your credit cards while applying for a mortgage and while your home is in escrow. You want the balances to stay as low as possible during this time.

If you have credit lines on your report still showing, despite the fact that you paid them off some time ago and aren’t using them, don’t close them. Leaving them alone is good for your credit, because a big part of determining your credit score and credit worthiness for getting a mortgage loan focuses on how much credit you have versus how much of it is in use. You want a high amount of credit and a low amount of it in use.

If you have credit lines on your report still showing, despite the fact that you paid them off some time ago and aren’t using them, don’t close them. Leaving them alone is good for your credit, because a big part of determining your credit score and credit worthiness for getting a mortgage loan focuses on how much credit you have versus how much of it is in use. You want a high amount of credit and a low amount of it in use.

In addition to major credit cards, it’s a good idea to have other debt represented on your credit report, such as student loans and car loans. Known as

In addition to major credit cards, it’s a good idea to have other debt represented on your credit report, such as student loans and car loans. Known as  At least six months prior to applying for a mortgage, avoid adding new credit of any kind. Even minor credit additions can diminish your chances of getting a mortgage loan. Except for paying off debt, leave all of your accounts alone during this time.

At least six months prior to applying for a mortgage, avoid adding new credit of any kind. Even minor credit additions can diminish your chances of getting a mortgage loan. Except for paying off debt, leave all of your accounts alone during this time.

How long it takes to get your score up to snuff for a mortgage depends on a lot of things. This includes what your score is now, and how much money you have available to pay off current debts. Reaching your financial goals doesn’t happen overnight, but keep moving, saving, and preparing your credit. You’ll reach your goal of buying a new home in no time!

How long it takes to get your score up to snuff for a mortgage depends on a lot of things. This includes what your score is now, and how much money you have available to pay off current debts. Reaching your financial goals doesn’t happen overnight, but keep moving, saving, and preparing your credit. You’ll reach your goal of buying a new home in no time!

When it comes to financing for flipping houses, De Meire has used just about every financing avenue available. “There are many ways to acquire and finance property. Don’t limit yourself to the traditional loans for flipping houses. I’ve done it all.”

De Meire’s company operates in California, Arizona, and Nevada and for 27 years has tracked and reported on foreclosures, including defaults, trustee sales and REOs (repossessed property by banks and lenders). The company also processes foreclosures for lenders.

When it comes to financing for flipping houses, De Meire has used just about every financing avenue available. “There are many ways to acquire and finance property. Don’t limit yourself to the traditional loans for flipping houses. I’ve done it all.”

De Meire’s company operates in California, Arizona, and Nevada and for 27 years has tracked and reported on foreclosures, including defaults, trustee sales and REOs (repossessed property by banks and lenders). The company also processes foreclosures for lenders.

Once the lender determines how much you can borrow and the interest rate you qualify for, most lenders will provide a letter that states this information. You can show this letter to a real estate agent looking for a home on your behalf, so he or she can guide you to homes in your price range.

You can also show the letter to sellers to show them that you are qualified and therefore serious about any offers you make. Sellers will be more likely to accept your offer when they know you’re pre-qualified.

If you’re negotiating to buy a house and don’t want the seller to know that you’re pre-qualified for more than you’re offering, ask your lender to give you a letter that coincides with the amount you’re offering. For example, if you’re pre-qualified for $375,000, but you’re offering $325,000, ask for a letter that states that you’re pre-qualified for the smaller amount.

Buying a home is an exciting venture. Make the process run more smoothly by taking the time to pre-qualify for a home loan before you start house hunting. For information on the best home loans available, consult SuperMoney’s

Once the lender determines how much you can borrow and the interest rate you qualify for, most lenders will provide a letter that states this information. You can show this letter to a real estate agent looking for a home on your behalf, so he or she can guide you to homes in your price range.

You can also show the letter to sellers to show them that you are qualified and therefore serious about any offers you make. Sellers will be more likely to accept your offer when they know you’re pre-qualified.

If you’re negotiating to buy a house and don’t want the seller to know that you’re pre-qualified for more than you’re offering, ask your lender to give you a letter that coincides with the amount you’re offering. For example, if you’re pre-qualified for $375,000, but you’re offering $325,000, ask for a letter that states that you’re pre-qualified for the smaller amount.

Buying a home is an exciting venture. Make the process run more smoothly by taking the time to pre-qualify for a home loan before you start house hunting. For information on the best home loans available, consult SuperMoney’s

Before you can determine the best ratio for managing your personal finances in terms of how much to save, spend and invest, you must take inventory. This means computing your income and expenses and using those totals to determine your discretionary income.

Before you can determine the best ratio for managing your personal finances in terms of how much to save, spend and invest, you must take inventory. This means computing your income and expenses and using those totals to determine your discretionary income.

How much of your discretionary income you save will depend on whether you have an emergency fund or not. If you have no

How much of your discretionary income you save will depend on whether you have an emergency fund or not. If you have no  The amount of money you

The amount of money you  How much you spend per month on discretionary items is a personal decision that directly affects how much you are able to save and invest. In order to decide on an amount for your budget, it’s important to look at your available funds, as well as your savings and investing goals. If possible, plan to spend what is left over once you meet your savings and investing goals each month.

How much you spend per month on discretionary items is a personal decision that directly affects how much you are able to save and invest. In order to decide on an amount for your budget, it’s important to look at your available funds, as well as your savings and investing goals. If possible, plan to spend what is left over once you meet your savings and investing goals each month.